Customer Acquisition Cost – CAC

Customer Acquisition Cost (CAC), is a critical business metric used by organizations around the world.

What does Customer Acquisition Cost – CAC mean?

The Customer Acquisition Cost is the sum of all costs for sales and marketing activities that are used to acquire new customers. CAC is an indicator of how much a company invests and how efficiently it uses these investments to acquire customers. Customer Acquisition Cost is one of the factors that determine whether a SaaS company has a viable business model. In this article, we will show the importance of CAC for the success of a subscription company.

Formula and calculation of customer acquisition cost

The basics of CAC calculation

For a better understanding, CAC is the sum of investments in marketing and sales divided by the number of customers acquired in the same period. It is an essential metric for measuring the financial health of a company. Customer acquisition costs are calculated monthly, taking into account sporadic fluctuations. The first step in calculating it is to neglect all areas of the business that are not directly related to customer acquisition. Some examples are: Product Department, Support, Management, etc. On the other hand, only the marketing and sales departments are taken into account, as well as the number of new customers in the desired period.

- Investments you should consider in marketing: Salaries, tools, media (e.g., ads), events, and anything else used to showcase a product and ultimately generate leads for the sales team.

- Investments you should consider in sales: Salaries, commissions, tools, telephony, travel, and all the infrastructure used by sales to acquire new customers.

- New customers: Finally, we need the number of new customers acquired during the same period.

The calculation of the CAC

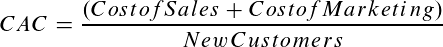

When all the values of the above are available, we simply apply the following formula:

CAC = (Marketing investment + Sales investment ) / Number of new customers.

This metric not only indicates whether your business is economically sound, but can also greatly help marketers make strategic decisions and optimize investments. For the Subscription Business, Customer Acquisition Cost must be less than CLV (Customer Lifetime Value), which is roughly the average amount each customer will spend in the company over their lifetime.

Measures to reduce the customer acquisition cost

Companies want to grow and reduce costs. An important metric here is the customer acquisition cost. However, this requires adjustments and optimization in the company’s operational practice. Here are a few tips for reducing the customer acquisition cost:

- Investing in good content: Those who invest in quality content that provides answers and/or solutions to the needs of potential customers become the reference in the field in which they operate. Building credibility is essential for the potential customer to ultimately trust a brand and ultimately purchase a product or service.

- Correct targeting: In order to optimize the Customer Acquisition Cost, it is necessary to know exactly the target group of the service being offered. In this way, it is possible to understand the behavior of the buyer during the customer journey and have relevant content ready for each stage of the sales funnel. This enables companies to channel their investments in marketing and sales activities and direct them to the right channel with the appropriate segmentation.

- Loyalty to customers (CRM) so that they remain faithful to the company and can become promoters of your company to other new customers in the future.

- Monitoring: companies should plan well and set benchmarks before implementing the reduction measures. All indicators should be tested and monitored to avoid excessive spending.

Conclusion: using CAC metrics can improve a company’s results

CAC is a very important key performance indicator (KPI), especially in the subscription business, which can tell a lot about the ability of companies to turn investments into real profit. Reducing CAC by optimizing or diversifying channels is one of the biggest challenges to overcome. With proper marketing, knowledge of the target audience, and planned and targeted investments, it is possible to reduce Customer Acquisition Costs and thus improve a company’s profits.