The XRechnung Standard

XRechnung is an XML-based semantic data model that can be used to send electronic invoices to public clients in Germany (at federal, state or municipal level) according to the specifications of the European Committee for Standardisation (CEN).

What is XRechnung?

XRechnung is an XML-based semantic data model that can be used to send electronic invoices to public clients in Germany (at federal, state or municipal level) according to the specifications of the European Committee for Standardisation (CEN). All public sector clients in Germany will gradually switch to electronic receipt of invoices, preferably in the XRechnung format. The data model is a national variant of the EU standard EN 16931, a so-called Core Invoice Usage Specification (CIUS). XRechnung also facilitates the implementation of the EU Directive 2014/55/EU. This directive obliges all principals or traders to receive and process electronic invoices. Invoices of EUR 1,000 or more must be transmitted electronically to contracting authorities in the future.

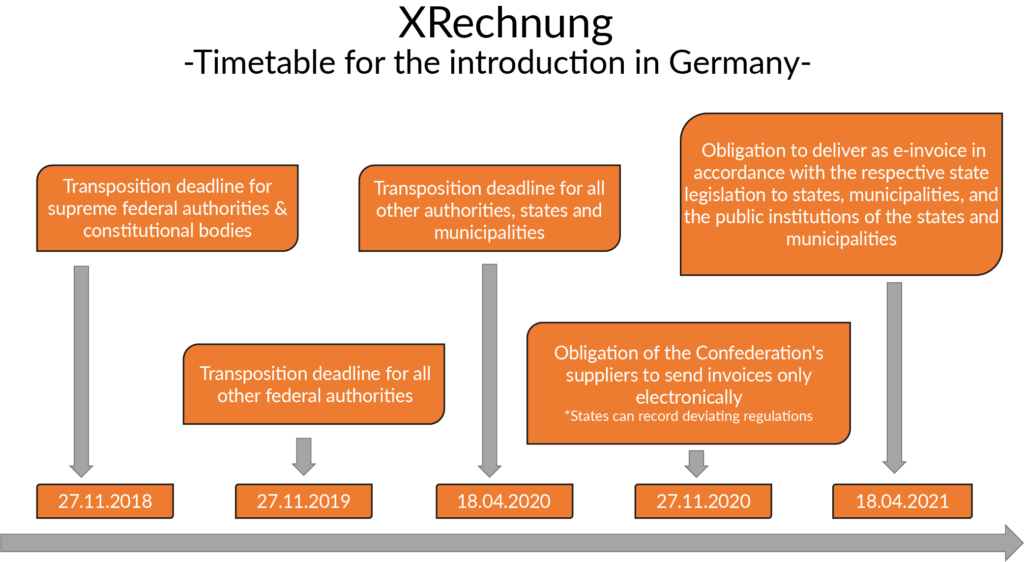

From 27 November 2020, suppliers to the federal government will also be required to submit invoices electronically to the federal authorities in accordance with certain format specifications so that they are not rejected.In order for an XRechnung to be correctly delivered from the invoicing party to the invoice recipient, the invoice recipient must be clearly identified. This is done by using a unique identifier that uniquely identifies the bill recipient, called the routing ID. In this article we look at the XRechnung format and its relevance for one-off and recurring invoices.

XRechnung corresponds to the official e-invoice of the European Union

E-invoices consist of data from structured invoices that can be processed automatically. A simple PDF document without a corresponding XML data set can therefore not be considered a genuine electronic invoice. Not even if the PDF invoice is transmitted completely digitally, e.g. by e-mail, to the final recipient. Therefore, a scenario is quite conceivable in which simple PDF invoices via e-mail would no longer be accepted by many public customers in the near future. More specifically, XRechnung is the electronic invoice format of the IT Planning Council for the Federation and the Länder, as it is a German specification for electronic invoicing for public administrations and consists only of a structured data set.

Creating XRechnung as standard?

According to the EU Directive, XRechnung are not “real” electronic invoices that can be easily processed automatically. On 28 June 2017, the standard developed by CEN “CEN/TC 434 – Electronic invoicing “was published in two parts:

Part 1: Semantic data model for the central elements of an electronic invoice;

Part 2: List of syntaxes corresponding to EN 16931-1.

In summary, XRechnung provides an application specification for the semantic data model. It is intended that this should be the national standard in public administration. The main advantage is that it is fully documented and neutral for both the product and the producer. It is also available to everyone free of charge. The German Coordination Body for IT Standards (KoSIT) created this format, which was published by the IT Planning Council in June 2017. The same body is also responsible for the further development and revision of the standard.

Standard components and compliance with the standard

The standard XRechnung must meet the requirements listed here:

- Documentation of the XRechnung standard as PDF document

- Technical means to validate complementary national business rules as Schematron and XSL files.

- Technical representation of code lists in the OASIS “Genericode 1.0” standard

- Open source reference implementation for checking the compliance of an XML document with the standard

- Test messages

- Technical support for visualisation.

The electronic invoice only complies with the XRechnung standard if it is issued, transmitted and received in the form of an XML document that is valid in comparison to the standard and if it only uses the information elements of the semantic data model of the XRechnungs standard (according to its specification).

An Office file or a PDF file with embedded XML according to another standard may not be compliant. The conformity of an invoice is determined in two steps, the first being verification and the second assessment. If the result of the compliance verification is positive, the invoice must be accepted. If the result is negative, a conformity assessment can be used in the second step to decide how great the deviation from the standard is and whether the invoice should still be accepted and processed. If the deviations exceed the defined acceptance table, the invoice is rejected. This conformity assessment can be defined individually.

It is important to know that there is not one standard for e-invoices. Besides XRechnung, there is also the ZUGFeRD format, which is also used as a standard in invoice communication between two companies, administrations or authorities. The data structure of ZUGFeRD 2.1 is based on the EN 16931 standard, just like the XRechnung . The XRechnung meets the specific requirements of the German administration. ZUGFeRD, on the other hand, was specially tailored to the needs of the economy and, with version 2.1.1. in the XRechnung profile, also incorporates the specific requirements of the administration.

Conclusion: Standard for electronic invoices

The main objective of XRechnung is to create an electronic invoicing based on content and a neutral and standardised technology. XRechnung is compatible with national and international standards and will be required for invoicing in public procurement from 27 November 2020. However, it is also suitable for the simple, secure, fast and resource-saving exchange of invoices between companies. Thereby, the XRechnung example is not an exclusive format for invoice communication. Other formats, such as ZUGFeRD, also play an important role in the world of electronic invoices.

Want to know more about electronic invoices? Download the Billwerk+ Whitepaper on E-invoicing!